For dividend lovers, a long-awaited and frequently requested feature is now available: Throughout the entire web app, we are changing the dividend values from gross to net by default! In the portfolio settings, you can switch the dividend display back to gross values at any time. Additionally, you now have access to another metric: Your personal dividend yield. What advantages this brings you can be found here 👇

Net Dividend Becomes the Standard

In the feature voting, the display of net dividends was one of the most requested features. We are all the more pleased to make net dividends the new standard of the Parqet web app with today's update. From now on, wherever dividends are displayed, the net dividend is used as the basis and thus reflects the return that you as an investor ultimately keep. The fees and taxes included in the net dividend are automatically read out in the PDF import and can alternatively also be entered when manually adding activities.

Difference Between Net Dividend and Gross Dividend

As with regular salary, taxes and fees must still be deducted from the gross dividend before it lands in the account. An example: VW decides on a dividend payout of 5 euros per share before taxes. Corporate tax of 15% is first deducted from this gross dividend - leaving 4.25 euros (cash dividend). Then the solidarity surcharge (5.5%), capital gains tax (25%) and possibly church tax are deducted from this cash dividend. The actual payout (without church tax) in the example is therefore 3.02 euros net dividend.

Tax Allowances Are Included

The gross values of the dividend were previously not affected by tax allowances. For net values, however, your broker considers the tax allowance and therefore automatically adjusts the net values. Through the import via Zero-Click, you therefore automatically have the tax allowance taken into account.

Switch to Gross Dividends in the Settings

As mentioned, the net dividend is the new standard in Parqet. If needed, you can still display the dividend values in gross. To do this, open your portfolio dashboard and click on the gear icon next to your portfolio name. There you can turn off the net display via a checkbox.

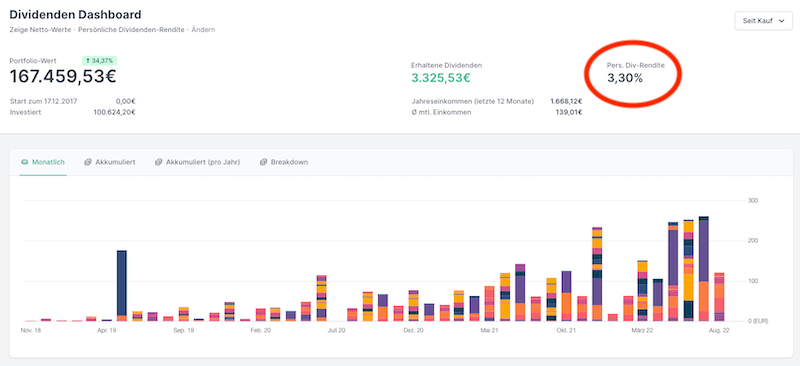

Your Personal Dividend Yield

In the course of the adjustment, we have also implemented another much-requested dividend feature: We now automatically calculate your personal dividend yield. In your personal dividend yield, your received dividend is calculated in relation to the entry price. For comparison: The regular dividend yield is calculated according to the dividend in relation to the current stock price.

An example: You buy a stock worth 50 euros with a dividend yield of 5%. In the first year, you receive 2.50 euros as a dividend (5% of 50 euros). In the second year, the price increases by 50% to 75 euros per share. With a constant dividend yield of 5%, you receive 3.75 euros (5% of 75 euros). In relation to your original investment of 50 euros, however, your personal yield is higher, namely 7.5% (3.75 euros of 50).

You can find the personal dividend yield in your dividend dashboard right next to the regular dividend yield.

Do you have questions or feedback on the new dividend calculation? We look forward to hearing from you in the community post about the feature!

New to Parqet?

With Parqet, we work every day to remove the barriers to wealth building. To do this, we build tools that allow you to keep track of your portfolio with little effort, whether at home or on the go.

See how Parqet can simplify your wealth planning, or create your free portfolio in seconds.

Create Portfolio