TTWROR vs. Return: New Metric and Comprehensive Performance Comparison

We developed these features based on community feedback (TTWROR, What-if comparison). If you have ideas for new features, feel free to vote on our Feedback page and help us make Parqet even better for everyone.

We're excited to introduce two features that many in the Parqet community have requested: the True Time Weighted Rate of Return (TTWROR) and a comprehensive performance comparison.

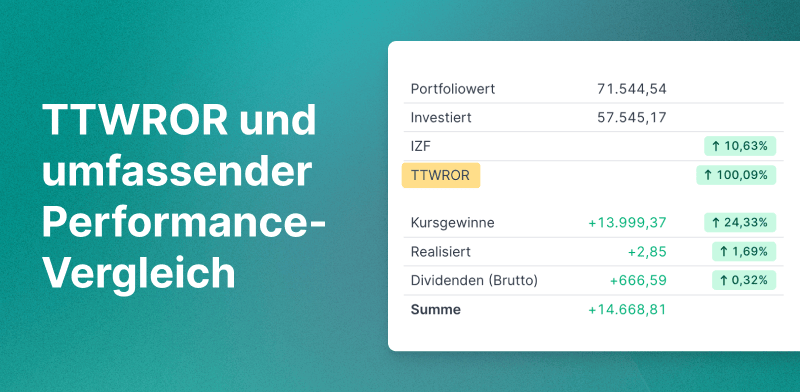

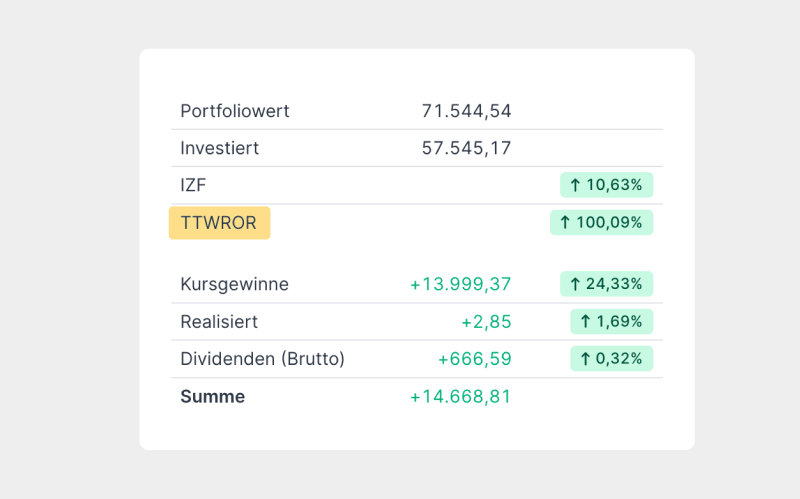

The TTWROR metric is available to all Parqet users in the Returns tab and for each individual holding. Parqet subscribers can additionally activate the metric in the performance chart and compare the TTWROR performance of a portfolio with other assets.

In this article, we explain what TTWROR is, how it differs from capital-weighted returns, and how it enables the often-requested "what-if" comparison.

What is TTWROR and how does it differ from returns?

The True Time Weighted Rate of Return (TTWROR) calculates the performance of a portfolio by showing the actual value development of investments, independent of the effects of deposits and withdrawals. By eliminating these capital flows, TTWROR provides an unbiased picture of portfolio performance and is therefore particularly suitable for comparisons with index funds or other benchmarks.

The traditional capital-weighted return, on the other hand, takes into account the amount of invested capital and shows the return based on the actual amounts invested and the times when they were invested. This metric is intuitively easier to understand, but can be distorted by deposits and withdrawals, e.g., with regular securities savings plans.

You can find a detailed comparison between TTWROR and returns including calculation examples in our FAQs.

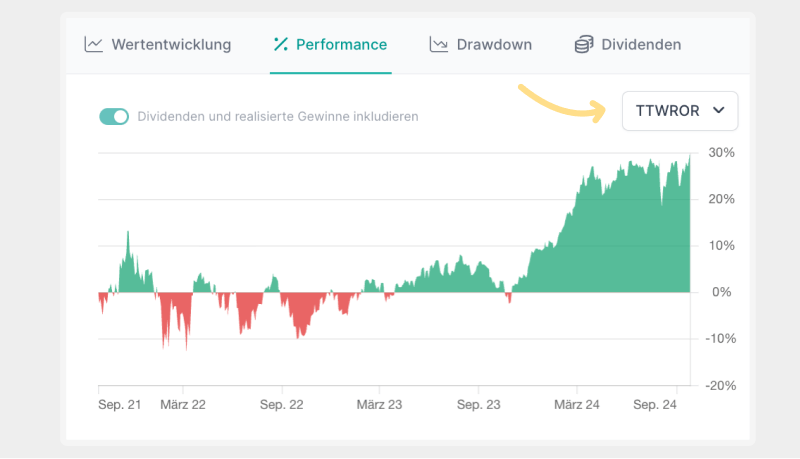

TTWROR as a performance chart enables a kind of "what-if" comparison

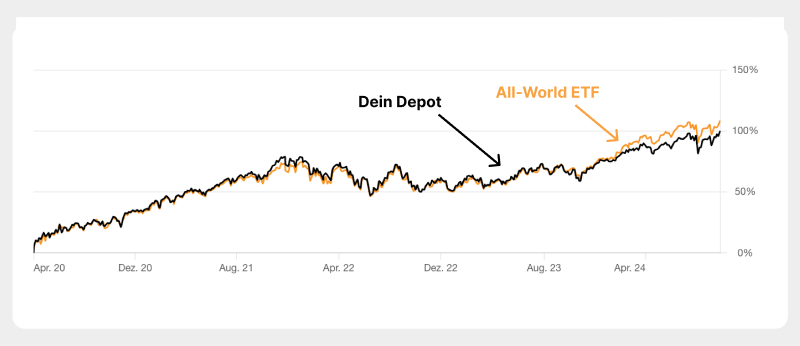

A special highlight is the ability to display TTWROR as a performance chart. This not only shows the development of a portfolio over time, but also allows scenarios to be simulated: What would have happened if, instead of the current portfolio, you had invested in an index fund like the FTSE All-World?

This "what-if" comparison is a powerful tool for evaluating different investment strategies and understanding how different decisions would have affected performance.

Unlike the previous direct return comparison, which merely compares performance data directly, the TTWROR comparison simulates alternative scenarios under the same market conditions. This results in real added value for more informed investment decisions.

TTWROR on the web and mobile app

The TTWROR metric is available to both subscribers and users of the basic plan, but with different functionalities:

- For all Parqet users:

- Dashboard in the Returns tab: TTWROR can be viewed here.

- For each holding: TTWROR is also available directly for each individual holding.

- For Parqet subscribers:

- Performance chart: In the performance chart, TTWROR can be activated via the selection box.

- Performance comparison: The comparison is only available to subscribers when TTWROR is activated in the chart.

This makes TTWROR available to basic users for improved performance analysis, as well as to Parqet subscribers with additional functionalities such as graphical representations and comparisons.

The mobile app also offers the performance comparison known from the web app, so that you can quickly and easily analyze on the go how your own investments compare to other assets or index funds.

Detailed FAQ article on TTWROR

To answer all questions about TTWROR and the performance comparison, we've created a detailed FAQ article. This article goes into detail about the mathematical calculation, the differences from capital-weighted returns, and various application scenarios. We recommend that all users who want to delve deeper into the subject take a look at our FAQ article on TTWROR. If you still have questions after that, you can of course contact us directly at any time.

Conclusion: More transparency and flexibility for your portfolio

With the introduction of the TTWROR metric, we offer Parqet users even more opportunities to analyze and compare their investments in detail. Whether it's the pure performance of your investments or a "what-if" comparison - now you have even more options for individual analyses and evaluations.

New to Parqet?

With Parqet, we work every day to lower the barriers to wealth building. To do this, we build tools that allow you to professionally monitor your portfolio without great effort, whether at home or on the go.

Check out how Parqet can simplify your wealth planning, or create your free portfolio in just a few seconds.

Create Portfolio